If you have just started a business and are trying to win your first clients, secure financing or find office space, it can be difficult to think beyond the next month, let alone several decades into the future.

Yet making decisions for the long term is important, especially when it comes to pension contributions. Not only is saving for retirement a sensible strategy for any entrepreneur, but it’s also an extremely tax-efficient way of extracting profits from your business.

“You’re getting maximum bang for your buck,” says Claire Trott, Divisional Director – Retirement and Holistic Planning at St. James’s Place Wealth Management. “It’s an allowable business expense, so it reduces your profits for Corporation Tax and is not subject to employer’s or employee National Insurance.”

Many entrepreneurs don’t realise how straightforward it is to begin saving into a pension. In this article, we will take you through some of your options and demonstrate how pension savings can be a smart, tax-efficient way to take capital from your business.

How do you set up a pension?

If you’re a limited-company director, it’s as simple as choosing a personal pension and following the steps to set it up. You could save with a recognised provider, who will offer you a range of funds to choose from, or via a Self-Invested Personal Pension (SIPP), where you have wider investment options which you can manage yourself or use a professional such as a fund manager to do for you. Alternatively, you could set up a company pension scheme.

After making your choice, the most important thing to do as a limited-company director is ensure the pension contributions are made through the company. If you pay yourself a salary and then make contributions from that, it’s subject to both employer and employee National Insurance, thus reducing the amount you can save into your pension. It is worth noting, however, that as soon as the company hires an employee, an auto-enrolment pension must be set up. Failure to do so can result in fines.

What are the tax benefits?

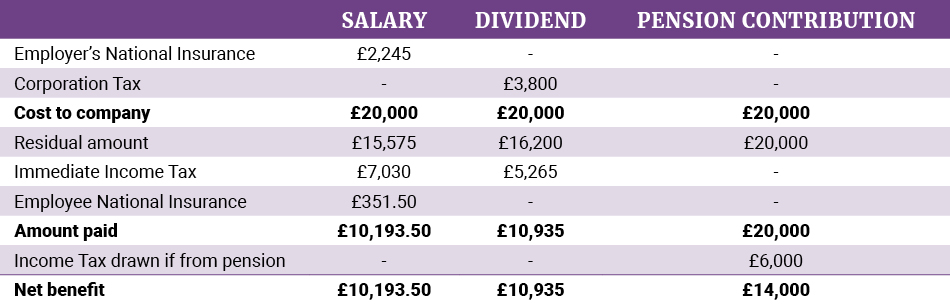

The table below shows the advantages of using business profits to save into a pension compared with paying yourself a salary or paying yourself through dividends. All assume the company has £20,000 to distribute and that the dividend allowance has already been used.

If you have just started a business and are trying to win your first clients, secure financing or find office space, it can be difficult to think beyond the next month, let alone several decades into the future.

Yet making decisions for the long term is important, especially when it comes to pension contributions. Not only is saving for retirement a sensible strategy for any entrepreneur, but it’s also an extremely tax-efficient way of extracting profits from your business.

“You’re getting maximum bang for your buck,” says Claire Trott, Divisional Director – Retirement and Holistic Planning at St. James’s Place Wealth Management. “It’s an allowable business expense, so it reduces your profits for Corporation Tax and is not subject to employer’s or employee National Insurance.”

Many entrepreneurs don’t realise how straightforward it is to begin saving into a pension. In this article, we will take you through some of your options and demonstrate how pension savings can be a smart, tax-efficient way to take capital from your business.

How do you set up a pension?

If you’re a limited-company director, it’s as simple as choosing a personal pension and following the steps to set it up. You could save with a recognised provider, who will offer you a range of funds to choose from, or via a Self-Invested Personal Pension (SIPP), where you have wider investment options which you can manage yourself or use a professional such as a fund manager to do for you. Alternatively, you could set up a company pension scheme.

After making your choice, the most important thing to do as a limited-company director is ensure the pension contributions are made through the company. If you pay yourself a salary and then make contributions from that, it’s subject to both employer and employee National Insurance, thus reducing the amount you can save into your pension. It is worth noting, however, that as soon as the company hires an employee, an auto-enrolment pension must be set up. Failure to do so can result in fines.

What are the tax benefits?

The table below shows the advantages of using business profits to save into a pension compared with paying yourself a salary or paying yourself through dividends. All assume the company has £20,000 to distribute and that the dividend allowance has already been used.

If you have just started a business and are trying to win your first clients, secure financing or find office space, it can be difficult to think beyond the next month, let alone several decades into the future.

Yet making decisions for the long term is important, especially when it comes to pension contributions. Not only is saving for retirement a sensible strategy for any entrepreneur, but it’s also an extremely tax-efficient way of extracting profits from your business.

“You’re getting maximum bang for your buck,” says Claire Trott, Divisional Director – Retirement and Holistic Planning at St. James’s Place Wealth Management. “It’s an allowable business expense, so it reduces your profits for Corporation Tax and is not subject to employer’s or employee National Insurance.”

Many entrepreneurs don’t realise how straightforward it is to begin saving into a pension. In this article, we will take you through some of your options and demonstrate how pension savings can be a smart, tax-efficient way to take capital from your business.

How do you set up a pension?

If you’re a limited-company director, it’s as simple as choosing a personal pension and following the steps to set it up. You could save with a recognised provider, who will offer you a range of funds to choose from, or via a Self-Invested Personal Pension (SIPP), where you have wider investment options which you can manage yourself or use a professional such as a fund manager to do for you. Alternatively, you could set up a company pension scheme.

After making your choice, the most important thing to do as a limited-company director is ensure the pension contributions are made through the company. If you pay yourself a salary and then make contributions from that, it’s subject to both employer and employee National Insurance, thus reducing the amount you can save into your pension. It is worth noting, however, that as soon as the company hires an employee, an auto-enrolment pension must be set up. Failure to do so can result in fines.

What are the tax benefits?

The table below shows the advantages of using business profits to save into a pension compared with paying yourself a salary or paying yourself through dividends. All assume the company has £20,000 to distribute and that the dividend allowance has already been used.